The rates presented are current for the date and time you submitted the address, but may change at any time with new tax legislation. In general, the rate ranges from 6.25% to over 8.50%, depending on where the vehicle is purchased. Owner-to-owner sales, however, are subject to a lower rate, which depends on the price of the vehicle and, in some situations, the model year.

- Then you apply the Social Security 12.4% to a base amount, established in 2020 as the first $137,700 of your net earnings.

- Your employer will also withhold money from each of your paychecks to put toward your federal income taxes.

- However if you do need to update it for any reason, you must now use the new Form W-4.

- Married couples filing jointly with an adjusted gross income over $500,000, and all other filing statuses with AGI over $250,000, can’t claim the education expense credit.

Calculates your taxes based on several inputs (your profession & income) and detects all possible deductions which ensures an accurate tax amount. The tax system in the US works on a pay-as-you-go basis, so the IRS collects income taxes throughout the year via payroll. Ideally, if you are a W-2 employee, you automatically get your taxes withheld by your employer. They have to pay a bit extra in “self-employment tax” to contribute to Social Security and Medicare.

How much is the self employment tax for Illinois?

Use ADP’s Illinois Paycheck Calculator to estimate net or “take home” pay for either hourly or salaried employees. Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. If you want more money in your Illinois paycheck, aside from asking for a raise, you can also work overtime if your job allows it. Other forms of supplemental wages you can seek include bonuses, commission, stock options and prizes. Supplemental wages are taxed at the same rate as regular income in Illinois. Up to this point, the deductions from your earnings we’ve talked about have been mandatory for everyone in Illinois.

2023 Paycheck Calculator Find Your Take Home Pay – Forbes

2023 Paycheck Calculator Find Your Take Home Pay.

Posted: Tue, 18 Apr 2023 13:23:58 GMT [source]

Food, drugs and medical appliances are all subject to a statewide tax rate of 1% of purchase price, in addition to local taxes of up to 1.25%, for a total tax of up to 2.25%. There are some food items that don’t count as a qualifying food. For example, candy and soda are generally subject to the higher “general illinois tax calculator merchandise” rate, but any candy containing flour is not, for sales tax purposes, classified as candy. Illinois has a flat income tax that features a 4.95% rate. This means that no matter how much money you make, you pay that same rate. Sales and property taxes in Illinois are among the highest in the nation.

What states have local taxes?

The Earned Income Tax Credit is currently 18% of the federal credit by the same name. The Education Expense Credit provides a credit to parents who spent over $250 on eligible K-12 education expenses. If you’re invoicing clients abroad, you could get a better deal on your international business transfers with a Wise Business account. We give you the same exchange rate you see on Google, no hidden markup fees.

Married couples filing jointly with an adjusted gross income over $500,000, and all other filing statuses with AGI over $250,000, can’t claim the education expense credit. Illinois does not have a standard or itemized deduction; instead, it offers a personal exemption of $2,375 for the 2021 tax year. For married individuals over 65 (or legally blind) that filed tax returns jointly, you’re allowed an additional $1,000. The 2.07% average effective property tax rate in Illinois is second-highest in the nation, behind only New Jersey.

What was updated in the Federal W4 in 2020?

The tax rates on this page apply to the 2020 tax season as Illinois hasn’t yet released its rates for the 2021 tax season. A financial advisor can help you understand how taxes fit into your overall financial goals. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Together these are called FICA taxes, and your employer will pony up a matching contribution.

- The state income tax rates are 4.95%, and the sales tax rate is 1% for qualifying food drugs and medical appliances and 6.25% on general merchandise.

- It varies by location, but is generally about 7% of the price of service.

- Sales and property taxes in Illinois are among the highest in the nation.

- For example, when you look at your paycheck you might see an amount deducted for your company’s health insurance plan and for your 401k plan.

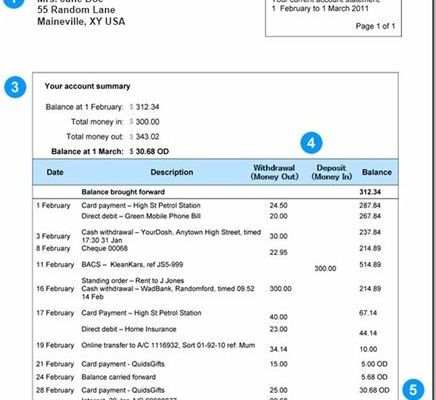

But some people might have more money taken from each paycheck. For example, if you pay a share of premiums for health insurance, life insurance or disability insurance through your company, that money will be deducted from earnings. You might also have money subtracted from your paycheck if you contribute to a 401(k), a flexible spending account (FSA) or a health savings account (HSA). Once you’ve found the correct sales tax rate for your area, you need to figure out how much to charge each customer on their purchases.

Illinois Median Household Income

In other states, the program is sponsored by Community Federal Savings Bank, to which we’re a service provider. Bonsai Tax is built exclusively for self-employed workers to track expenses, maximize tax write-offs, and estimate quarterly taxes.Discover Bonsai Tax. Automate returns preparation, online filing, and remittance with Avalara Returns for Small Business. Or, when done editing or signing, create a free DocuClix account – click the green Sign Up button – and store your PDF files securely. Or, click the blue Download/Share button to either download or share the PDF via DocuX. It’s a secure PDF Editor and File Storage site just like DropBox.

If your W4 on file is in the old format (2019 or older), toggle “Use new Form W-4” to change the questions back to the previous form. However if you do need to update it for any reason, you must now use the new Form W-4. The state of Illinois collects 39.2 cents for every gallon of regular gasoline. The diesel tax rate is also quite high at 46.7 cents per gallon. The telecommunications tax is a tax on services including home phone lines, cell phones, television service and internet. It varies by location, but is generally about 7% of the price of service.

In that case, your “paycheck,” whether in the form of a check or cash, was simply your hourly wage multiplied by the number of hours you worked. Simply download the lookup tool and enter your state, in this case Illinois. To determine the amount of Illinois self employment tax owed, you need to determine your annual earnings. Then you apply the Social Security 12.4% to a base amount, established in 2020 as the first $137,700 of your net earnings. The Medicare 2.9% is applied to all your combined net earnings. If you have a married couples business there are some variations in what you would file.

To calculate the right sales tax in Illinois you’ll need to add up the state, county and city rates for your location. The easiest way to do this is by downloading our lookup tool to get the detail you need in seconds. You can use our Illinois sales tax calculator to determine the applicable sales tax for any location in Illinois by entering the zip code in which the purchase takes place. You may also be interested in printing a Illinois sales tax table for easy calculation of sales taxes when you can’t access this calculator.

Illinois income tax calculator: How would Gov. J.B. Pritzker’s … – Chicago Tribune

Illinois income tax calculator: How would Gov. J.B. Pritzker’s ….

Posted: Mon, 11 Mar 2019 07:00:00 GMT [source]

That’s why pay frequency is a question on every paycheck calculator. A bigger paycheck may seem enticing but smaller, more frequent paychecks can make it easier to budget without coming up short by the end of the month. Employers withhold Social Security and Medicare taxes and make payments on behalf of their employees.

If your income marginal tax rate is the tax rate on the last dollar that you earned. If your income is $100 with 20% average tax rate and 30% marginal tax rate and if you get 1 dollar bonus, you pay 30% tax on that bonus. Easy step by step instructions to manually calculate your paycheck’s federal income tax, Social Security tax, and Medicare tax.

These are known as “pre-tax deductions” and include contributions to retirement accounts and some health care costs. For example, when you look at your paycheck you might see an amount deducted for your company’s health insurance plan and for your 401k plan. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. Some deductions are “post-tax”, like Roth 401(k), and are deducted after being taxed. You can use our Illinois Sales Tax Calculator to look up sales tax rates in Illinois by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.