Contents:

When you place an insurance claim on fixed assets, you must take certain accounting steps. Remove the asset from your books, but record the payout as a proceed. You can record the transaction when payment is possible or when you receive it. The best practice is to record the payout when you receive it. If the insurance policy carries a coinsurance clause, you are required to carry insurance to cover at least 60% of the asset’s fair market value. To calculate the loss on disposal of an asset, subtract the accumulated depreciation from the original cost, and then subtract the sales price.

Combining the $20,000 and the $18,000 results in a book value of $2,000. The second scenario arises when you sell an asset, so that you receive cash in exchange for the sold asset. Depending upon the price paid and the remaining amount of depreciation that has not yet been charged to expense, this can result in either a gain or a loss on sale of the asset. First, a new account called the disposal of fixed assets account is opened. In turn, the cost of the fixed asset being disposed of is transferred to this account. Suppose DBS Tires, a Canadian tire manufacturer, sold manufacturing equipment that originally cost $30,000 for $12,000 in cash.

The trade-in allowance of $10,000 plus the cash payment of $20,000 covers $30,000 of the cost. The company must take out a loan for $10,000 to cover the $40,000 cost. The trade-in allowance of $5,000 plus the cash payment of $20,000 covers $25,000 of the cost. The company must take out a loan for $15,000 to cover the $40,000 cost. The trade-in allowance of $7,000 plus the cash payment of $20,000 covers $27,000 of the cost.

Disposal of Fixed Assets: How To Record the Journal Entry

Anything under construction exists in an accumulation account (for example, Construction-in-Process) until the work is complete. Upon completion, an accountant will move the asset to the appropriate fixed-asset account. It gives a complete summary of all transactions relating to the sale of assets in one place. In these situations, the SEC staff has indicated that there are two acceptable interpretations of the literature for accounting for the loss on sale at the held-for-sale date. The carrying amounts are adjusted, if necessary, for the result of each test prior to performing the next test.

This is determined by comparing the asset’s carrying amount to the proceeds from the asset’s sale, if any. When the proceeds exceed the carrying amount, a gain on disposal is recognised. When the carrying amount exceeds the proceeds, a loss on disposal is recognised.

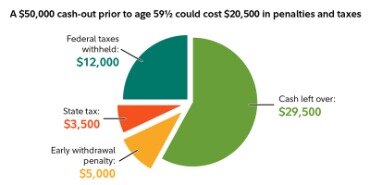

In the example below, accumulated depreciation is $45,000; the original cost of the asset is $75,000; and the sales price is $10,000. After depreciation, a loss of $20,000 is recognized on the disposal of the asset. Changes to the status of an individual asset do not signal impairment, and, frequently, only the estimated service life needs adjusting.

When an asset is sold, the business must account for its depreciation up to the date of sale. This means that as a first step, the business may be required to record a depreciation entry before the sale of the asset to ensure it is current. An important thing to take note of is partial-year depreciation. A business may only own depreciable assets for a portion of a year in the year disposal . Businesses must be consistent in how they record depreciation for assets owned for a partial year. A common method is to allocate depreciation expense based on the number of months the asset is owned at time of disposal.

Classification of Fixed Assets in Accounting

Such a receipt would show up in the Consideration received column. The second method is to post the transaction to Fixed assets – loss on disposal after disposal. The net effects are the same, but the second method would not show on the Fixed Asset Summary, because the transaction would not be posted directly to the asset’s subaccount. The effect of the first two entries is that the cost and accumulated depreciation are removed from the normal accounts. Also, the disposal of fixed assets account now shows the book value of the item to be disposed of. When there is a gain on the sale of a fixed asset, debit cash for the amount received, debit all accumulated depreciation, credit the fixed asset, and credit the gain on sale of asset account.

Loss due to any accident, fire, obsolescence, etc., during its useful life. Planned transactions involving foreign investments that, when consummated, will not cause a reclassification of some amount of the cumulative translation adjustment. Let us look at an example of a gain and loss alternative using the MAAS Corporation data. 10.5 Compute, interpret and compare return on investment and residual income. 10.2 Evaluate how responsibility accounting is used to help manage a decentralised organisation.

How to make the sale of assets journal entry

When you write something off the books, accounts with normal debit balances are credited and accounts with normal credit balances are debited. When there are no proceeds from the sale of a fixed asset and the asset is fully depreciated, debit all accumulated depreciation and credit the fixed asset. Using the preceding examples, we will subtract the accumulated depreciation of $15,000 from the machinery’s original cost of $50,000.

How to Properly Dispose of Electronic PHI Under HIPAA – HealthITSecurity

How to Properly Dispose of Electronic PHI Under HIPAA.

Posted: Wed, 28 Dec 2022 08:00:00 GMT [source]

Selling assets for the total depreciated value indicates that the business made no gain or loss upon selling them. Conversely, selling an asset for an amount exceeding the depreciated value means the businesses gained cash from the sale. A fixed-asset accountant is usually a certified public accountant who specializes in the correct accounting of a company’s fixed assets. Fixed-asset accountants often work with other accounting roles to calculate asset depreciation. They also ensure that accounting departments record and track assets correctly as well as handle tax accounting requirements for fixed assets.

Examples of Fixed Assets

This would only be applicable when the initial VAT at time of Purchase of your Asset was also processed as being Outside of Flat Rate (Value of purchase exceeding £2000). Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com. Net increase in cash during the seven months was a positive $1,750 (the combination of the totals of the three sections—operating, investing, and financing activities). This $1,750 agrees to the check figure—the increase in the cash from the beginning of January to July 31.

That is, you record the loss on sale of assets as a debit to the ‘loss on sale or loss on disposal’ account. Also, for the sale of land, if the buyer pays the seller exactly what he/she paid for the land, there will be no loss or gain on the sale. In order to calculate the gain or loss on the sale of assets, we, first of all, subtract the asset’s accumulated depreciation from its original cost and then subtract the resulting amount from the asset’s sale price. On the other hand, when the company incurs a loss by selling the assets, a ‘loss on sale of asset’ journal entry is to be booked.

On July 1, Matt decides that his company no longer needs its office equipment. Good Deal used the equipment for one month and had recorded one month’s depreciation of $20. This means the book value of the equipment is $1,080 (the original cost of $1,100 less the $20 of accumulated depreciation). On July 1, Good Deal sells the equipment for $900 in cash and reports the resulting $180 loss on sale of equipment on its income statement.

Integrating Cyber Into Warfighting: Some Early Takeaways From the … – Carnegie Endowment for International Peace

Integrating Cyber Into Warfighting: Some Early Takeaways From the ….

Posted: Wed, 19 Apr 2023 02:07:32 GMT [source]

In the Fixed Asset Summary, the Acquisition cost column includes all purchases and upwards revaluations. Consideration received includes all sales posted to the asset’s subaccount and downwards revaluations. Depreciation includes all depreciation during the reporting period.

Journal Entry for Purchase of Multiple Units in an Asset Group

You may end up recording a gain or loss on the asset disposal transaction during that financial period. In the Balance Sheet, such an asset is shown at its net value, which is obtained after deducting the amount of depreciation from the historical cost of such an asset. Gains on similar exchanges are handled differently from gains on dissimilar exchanges. On a similar exchange, gains are deferred and reduce the cost of the new asset. The $99,000 cost of the new truck equals the $12,000 trade‐in allowance plus the $89,000 cash payment minus the $2,000 gain. If the entire cost of an asset has been depreciated before it is retired, however, there is no loss.

The how to calculate overtime pay reflects the depreciation for that specific timeframe. Companies can utilize double declining method to identify how the value of an asset depreciates with time. Computing the disposal value using this technique involves dividing 1 by the useful life of the asset 1 and multiplying the result by 2. “For your business, the key is understanding the distinction between the capitalizable costs and those that should be immediately expensed. But broadly, if the cost you’re incurring is material and it is necessary to extend an asset’s useful life beyond one year, then that is a cost that should be capitalized,” advises Adams.

How To Record?

For example, a business with a 30th June financial year, disposes an asset with an annual depreciation of $10000 on 1st January. In this instance, the depreciation expense would thus be $5000 ($10000 × 6/12), instead of $10000. The first is to post a receipt in the Receipts & Payments tab to Fixed assets, at cost and the specific asset’s subaccount prior to recording disposal. This reduces the purchase cost balance, decreasing any loss on disposal.

Asset impairment is akin to an advanced depreciation, which is when you reduce the potential benefit from an asset. When fixed assets undergo a significant change in circumstance that may reduce their gross future cash flow to an amount below their carrying value, apply an impairment test. Below is an impairment journal entry when the loss is $50,000. A similar situation arises when a company disposes of a fixed asset during a calendar year. The adjusting entry for depreciation is normally made on 12/31 of each calendar year.

- The balance is usually 0.00 because the clearing account gets credited and the fixed-asset account is debited the same amount.

- The net amount of cash provided or used by operating activities during the month of July was $0.

- Brainyard delivers data-driven insights and expert advice to help businesses discover, interpret and act on emerging opportunities and trends.

- The adjusting entry for depreciation is normally made on 12/31 of each calendar year.

- Depreciation refers to the decrease in the value of assets of the company over the time period due to use, wear and tear, and obsolescence.

An important takeaway from this is that a non-current asset may be sold for more or less than its recorded book value (i.e. carrying amount), which will result in a gain or loss, which must be recognised. If, on the other hand, the disposal of fixed assets account shows a credit balance, this denotes a gain or profit on the sale of the fixed asset. After making the above-mentioned entries, the disposal of fixed assets account shows a debit or credit balance.

Book value is determined by subtracting the asset’s Accumulated Depreciation credit balance from its cost, which is the debit balance of the asset. A company may no longer need a fixed asset that it owns, or an asset may have become obsolete or inefficient. Prior to discussing disposals, the concepts of gain and loss need to be clarified.

Islamabad police chalk out security plan for Chand Raat, Eid – Business Recorder

Islamabad police chalk out security plan for Chand Raat, Eid.

Posted: Fri, 21 Apr 2023 00:56:58 GMT [source]

The equipment will be disposed of on 4/1 in the fourth year, which is three months after the last annual adjusting entry was journalized. The first step is to journalize an additional adjusting entry on 4/1 to capture the additional three months’ depreciation. Since the annual depreciation amount is $1,200, the asset depreciates at a rate of $100 a month, for a total of $300. The company breaks even on the disposal of a fixed asset if the cash or trade-in allowance received is equal to the book value.