The resulting number is the beginning inventory cost for the next accounting period. To understand if that’s a good or bad value depends on your business and the product being sold. However, generally speaking, higher ratios often show that you either have very strong product sales or do not keep enough stock available to meet the market demand. You are either not selling a lot of products or have too much stock on hand. The inventory average cost method takes the total cost of goods purchased or manufactured and divides it by the total number of items purchased or manufactured.

A company may choose to use a moving average inventory when it’s possible to maintain a perpetual inventory tracking system. This allows the business to adjust the values of the inventory items based on information from the last purchase. Companies using the perpetual inventory method in accounting have a continuous real-time record of inventory.

- Inventory is the total of all the goods ready to be sold and all the raw material stored in the warehouse of a given company.

- For the 2018 fiscal year, you can use the same methods as above to identify the average inventory as $625,000.

- You must figure out the beginning inventory if you don’t have the ending inventory from the prior accounting period.

- Missed sales prospects and empty store shelves might result from having insufficient goods on hand.

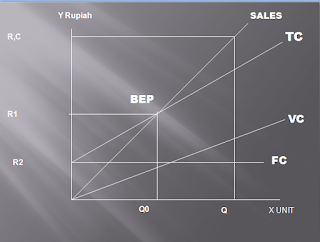

After the peak seasons, the inventory balance would be relatively low while abnormally high in the off-peak. This phenomenon is expected in the textile industry, depending on the weather seasons. You can calculate the average inventory by dividing the beginning inventory ($450,000) by 2, then add the closing inventory ($550,000). We can find the inventory turnover by dividing the cost of goods sold ( $5,000,000) by the average inventory. In the fiscal year 2018, the company published had $350,000 and $450,000 for their beginning and ending inventories, respectively.

Management of costs, sales, or even relationships all depend on it. So if you can keep a crisp inventory, there will be fewer hurdles for your business. ABC Limited is a 4-year-old, rapidly growing food and beverage company. In the fiscal year 2017, the company published in their financial statements including $450,000 and $550,000 for beginning and ending inventories, respectively. Average inventory example, if your company’s beginning inventory for January is $10,000 and the ending inventory for January is $15,000, the average inventory for January would be $12,500. To calculate ITR, you need to divide COGS by the average inventory.

The calculation is based on the month-end inventory balance, which may not be representative of the average inventory balance on a daily basis. With average inventory, your business can know how much inventory is available for sale or production. You can also use average inventory figures to compare sales volume in different accounting periods. The feedback can be handy in monitoring inventory losses and ensuring that you don’t over or under-order stock. Ending Inventory BalanceThe ending inventory formula computes the total value of finished products remaining in stock at the end of an accounting period for sale. It is evaluated by deducting the cost of goods sold from the total of beginning inventory and purchases.

How to calculate average inventory

The items you have on hand must be physically counted at the conclusion of each accounting period. After that, you may use those figures to enter into the method above to get your average. For the current accounting period, you must be aware of the ending inventory and cost of goods sold. FIFO – When determining how much inventory was sold in a specific time frame, this method uses the inventory that was purchased initially. COGS is a line item on the income statement, which covers financial performance over time, whereas inventory is taken from the balance sheet.

Brainyard delivers data-driven insights and expert advice to help businesses discover, interpret and act on emerging opportunities and trends. By this same token, many companies make their biggest sales pushes at the end of a period, so the numbers may skew, giving you a false impression of overall sales and productivity. With the help of the method in this article, you will soon be tracking your inventory like an expert. Required for different numbers- As you’ll see in the section below, you need this number to calculate other ratios, such as those that reveal how frequently you sell your complete inventory. Divide your EOQ by 2 to get the average inventory from your EOQ.

It means that, on average, the value stored in the supermarket warehouse in January 2019 was $10,000. Using an average estimation instead of a punctual one, you may not detect high volatility, which is important to eliminate (i.e., running out of inventory). For example, common practice allows the calculation to be based on a month-end inventory balance, but it can be very different if calculated on a day-end inventory balance. Lower DSI is usually desirable, but like inventory turnover ratio this will vary by industry. Benchmark your DSI against peer companies to get idea of performance.

Let’s say that your latest shipment of widgets was much more expensive than normal. Instead of paying $520, you had to pay $835 for the same amount of widgets. And to keep the math simple, we’ll also say you reordered before selling a single widget since you were anticipating prices rising even more. And there you have it, your average value of inventory for the first quarter was $5,500. For our example, let’s say your beginning inventory for the first quarter was $5,000.

Benefits of Calculating Average Inventory

Companies that use the perpetual inventory method can use a moving average inventory to compare inventory averages across multiple time periods. Moving average inventory converts pricing to the current market standard to enable a more accurate comparison of the periods. Average inventory is a calculation of inventory items averaged over two or more accounting periods. To calculate the average inventory over a year, add the inventory counts at the end of each month and then divide that by the number of months. Remember to also include the base month in fiscal year average inventory calculations which also means you would divide that sum by 13 months rather than 12. Average inventory figures for other stretches of time are similarly calculated.

Average inventory is a calculation that estimates the value or number of a particular good or set of goods during two or more specified time periods. Before explaining what the average inventory is used for and its benefits, let us give a basic definition of inventory. Inventory how to calculate average inventory is the total of all the goods ready to be sold and all the raw material stored in the warehouse of a given company. The average inventory is the mean value of an inventory during a determined period of time. It estimates, on average, the value or the number of goods stored.

Now that we know what average inventory is and have a better understanding of how companies use it, let’s talk about the actual formula that you’ll need to make this important calculation. You may maximise your revenues by managing your inventory profitably. It serves as a tool for comparison and aids in the analysis of the total revenue made by your company.

TheAverage Inventory Period is the approximate number of days it takes a company to cycle through its inventory. To understand if that’s a good or bad value, again, it is hard to say anything as it depends on your business and the product being sold. However, knowing how long an item stays in your warehouse is useful data to have when it comes to managing your inventory. But, again, this is only possible with restaurant inventory software. Automated calculation and perpetual inventory are necessary and conserve resources when it comes to performing a regular inventory audit in your warehousing environment. So whether you’re using perpetual or periodic inventory systems, this inventory metric can work.

The average inventory does not appear directly on the balance sheet. This is supposed to be converted to cash within the fiscal year. Once the inventory is sold, the cost is recorded on the balance sheet under the cost of goods sold section. The average inventory cost is more valuable if the cost is a moving target. This average inventory type can only be used by a business that keeps a perpetual inventory tracking system.

A retailer’s beginning inventory includes all products available and ready to be sold to customers. Beginning inventory allows businesses to better recognize their sales and operational trends. Measuring and analyzing beginning inventory offers insight into the value of products on hand and can improve business strategy and efficiency.

Drawbacks of Average Inventory

These solutions allow you to quickly view your manufacturing and material expenses. You won’t always have a clear view of your inventory if you only consider one moment in time. Your line of work can also be seasonal, such as selling frozen yogurt in the summer or Christmas décor in the winter.

Why is it important to know the average inventory period?

Earlier we stated that to calculate average inventory, you need only divide the sum of beginning and ending inventory by two. You’d apply that cost to your beginning and ending inventories, and calculate the average using monetary value. That’s as opposed to the average inventory level, which doesn’t involve costing. By providing accurate and consistent numbers over long periods of time, average inventory helps in many ways. So if your inventory turnover rate is four and you want to find your annual number, you’d divide 365 by four.

And when that cost is a moving target, average inventory cost is helpful. If you were to consider only the quantity of units and not their price, that’s how to calculate average inventory level). Companies calculate average inventory by assigning a dollar value to the inventory it averages.

The median is the point where half the numbers in the sample have values higher than the median value and the other half have values lower than the median value. (In the case of our sample range, the median value is 7.) The median may be the same as one of the values in the sample range, or it may not. Until the inventory is sold and converted into cash, the cash cannot be used by the company, because the cash is tied up as working capital. Let’s take the turnover ratio we calculated above to set up the equation. ProductCLOUD FULFILLMENT PLATFORM Logiwa has built a fully integrated WMS and cloud order fulfillment software solution for B2C and DTC businesses.

Too little inventory on hand can lead to missed sales opportunities and empty store shelves. Just the right amount of inventory propels a company forward and mirrors its strengths in managing costs, sales and business relationships. Again, what a good average inventory period is will vary depending on your company and product.

To get the average inventory from your EOQ, you divide your EOQ by 2. Well, it goes back to a big assumption the math makes–essentially, the average amount of inventory you hold onto SHOULD be about half of your EOQ, or the amount you’re reordering. When you do the math, you see that the cost for each unit in your inventory has jumped from $0.958 to an even $1. At that price point, you may need to raise the price of your products by $0.05 each to ensure you continue to make a profit. For example, let’s say you want to calculate your average amount of inventory for the year’s first quarter.

So this inventory statistic can be used with either perpetual or periodic inventory systems. You must figure out the beginning inventory if you don’t have the ending inventory from the prior accounting period. A more sophisticated forecasting approach looks at specific variables affecting demand.